Disclaimer

All comments reflect the personal opinion of the Ross McDonald and do not represent the views of any corporate organization, credit union, regulatory body, government ministry or any other organization or person. Although the author has made significant effort to ensure that presented information was accurate at the date of completion then the author does not assume any liability to any party for any loss, damage, or disruption caused by errors or omissions, whether such errors or omissions result from negligence, accident, or any other cause. Ross recognizes numerous system veterans that generously offered system memory, technical expertise and professional encouragement to support authorship of these publications. They are better, and I am wiser, for your thougthful insight. Thank you.

Statutory Liquidity Deposits – High Quality Liquid Assets (HQLA)

Treasury tactics for smaller credit unions

B.C. and ON credit unions faced new liquidity regulations; unfamiliar treasury products; and limited technology systems. Six tactics for smaller credit unions

Proportionality in financial regulations

Asset size, business complexity & risk profile should matter

BCFSA, BC credit union financial regulator, may seek maximum data collection regardless of proportionality, prudential supervisory risk or industry impact

Hello Purpose!

CFO CRO – Community Savings Credit Union

From 2020 to 2022, Ross was Chief Financial Officer and Chief Risk Officer of Community Savings Credit Union, a regulated Canadian financial cooperative

FIA / CUIA Legislative Review – Empowering CUDIC – Beyond FICOM’s Shadow

An Alternative Regulatory Structure for B.C. credit unions

CUDIC covers C$77 billion deposit insurance. It warrants full-time, permanent executive leadership and deserves independent, empowered & accountable governance

Credit Union Deposit Insurance Policy – 1 of 2

Overview, History, Pros & Cons

Western Canada credit unions have leveraged unlimited deposit insurance policy to boost growth and confidence. But it elevates moral hazard and may be expensive

Credit Union Deposit Insurance Policy – 2 of 2

Costs, Benefits & Regulation

B.C. credit unions face three policy options for deposit insurance. No right or wrong policy, but material implications for the credit union industry

System Level Leadership Vacancies – 1 of 3

Empty Seats

Empty seats. All leaders of credit union centrals and relevant provincial government entities are currently appointed on an interim, acting or retiring basis

System Level Leadership Vacancies – 2 of 3

Visionaries Wanted

Visionaries wanted. To advance impactful, perhaps disruptive, change then permanent leaders of system-level credit unions must be bold, persistent & persuasive

System Level Leadership Vacancies – 3 of 3

Glass Slippers

Glass slippers. Governance bodies need to adopt a sophisticated, pragmatic and urgent approach to recruit permanent leadership of credit union system entities

Federal Credit Union Value Propositions

Beyond Ice Cream & Sprinkles

Strategy academics may frame the value propositions of Canadian credit union as Ice cream with sprinkles, to reflect their commonalities and variations

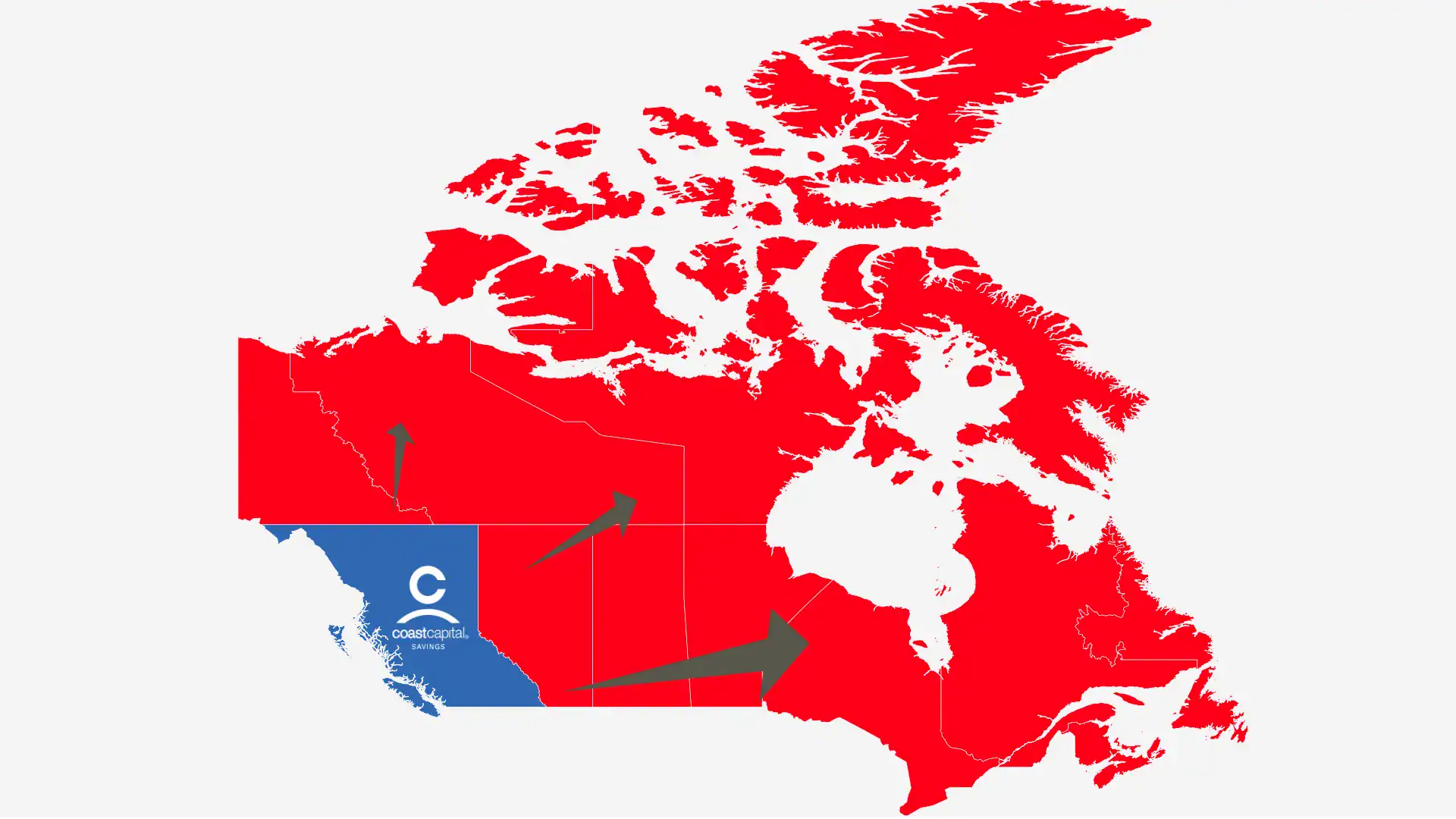

Coast Capital Savings Credit Union

Strategy – ‘Good Morning Canada!’

Through member approval of its federal strategy, Coast Capital Savings Credit Union broadcasted ‘Good Morning Canada!’ to Canadian financial services industry

Credit union regulatory intervention

An ERM failure?

Credit unions under regulatory intervention often need remedial assistance. Does this signal ineffective Enterprise Risk Management at the credit union?